De Minimis

De Minimis

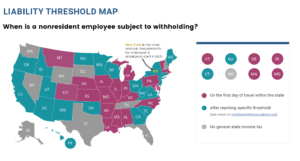

Traveling for business to a state that is not your primary working state exposes the traveler employee to taxation and to filing requirements in that state, and also exposes the employer to withhold and pay to that state its allocable share of the overall withholding tax deducted from the employee’s income. Basically, states can tax traveler employees’ income from the first Dollar allocated to that state, however, to ease on the administrative burden, many states adopted rules to provide for a de-minimis threshold, for light travelers or to immaterial income earned in such state. Some states also entered into reciprocity agreements on which we will discuss in a separate post.

States adopted different and unrelated de-minimis rules, which, if you have several employees that travel to more than one state, requires the employer to comply with many different rules, guidelines and policies.

Here are some examples of the de-minimis rules applicable in 2018:

| State | Criteria | Policy |

| New York | First day of travel | Only after 14 days of travel |

| Connecticut | First day of travel | Only after 15 days |

| New Jersey | First day of travel | |

| Pennsylvania | First day of travel | First $ earned within state |

| California | $ amount ($1,500) | |

| South Carolina | $ amount ($1,000) | |

| Maine | 10 days | |

| Ohio | 20 days | |

| Georgia | 23 days OR $5,000 Or 5% of total income | |

| Utah | 60 days |