When you get a letter from state tax authority that it initiates a withholding audit, you say to your self, “ then God I’m using that prestigious payroll company”. The problem is that the tax authorities do not care about the taxes withheld, they are interested in the taxes you have not withheld. They care about your out-of-state employees (non-resident employees) that came over for a few days of work, and they care about out-of-state employers which employees are traveling to the state for work.

hat will you choose? If you choose the former, you may pay more than what you really owe (or less), if you choose the latter, you will have examiners at your business for a long period of time, going through hundreds of documents causing you a tremendous amount of legal fees.

So, what happens when you get that audit letter. A lot. You need to engage payroll, you need to engage HR, and you need to engage state counsel, your accountant and a lot of attention.

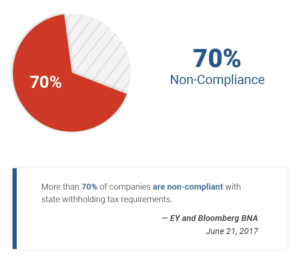

The state tax auditors will perform their audit by examining employees colanders, cell phone call reports, EZ-Pass, and credit card (expense report). They will check if and to what extent employees visited in that state to calculate the days visited in (or the amount of income allocated to) that state. After concluding the result, a deficiency letter may be issued (well, it may not be issued if you are among the 30% businesses in the US that somewhat comply with the complex withholding tax rules). In the deficiency letter, they will include the amount of tax, interest and penalties are owed to that state. In most cases, the examiners will only audit a few (or a few more than a few) employees and extrapolate the rate of deficiency to the entire amount of compensation paid to your employees. You can now choose, except that extrapolation, or demand the tax authority to conduct an audit on all of your employees. W

So, will you take the audit risk?

Let me tell you a personal note (as a former tax authority examiner), the worst thing for an examiner is to find out that during an audit that the taxpayer you’re auditing has complied with all the complex withholding rules. Here the examiner reaches a not so good of ROI (of time).

So, still thinks it makes sense to take the audit risk?